Whether your company is fully product-led, or if PQLs are just one piece of your demand pipeline, a product-led sales motion requires agility, flexibility and the ability to make changes quickly. Because of that, product led growth (PLG) companies are perfect for dynamic book management.

So how does a PLG company successfully integrate product-qualified leads (PQLs) into a sales motion? In this post, we’re going to talk about identifying PQLs, assigning them to sales reps, and how dynamic book management fits in. First up: assigning PQLs, and we’ll come back to a discussion about identifying PQLs in the second half of this post.

What's the best way to assign PQLs to sales reps?

Once you've identified a PQL (more on that below), you need to assign that account to someone. So let's talk about PQL distribution. It can be particularly complex to incorporate product-qualified leads along with other inbound and outbound lead sources.

This requires coordination and agreement between sales and marketing. Identifying PLG leads is a process that doesn’t clearly live in sales, marketing or customer success. It’s a joint effort across the organization. What criteria are required for a user to become a PQL? You have to agree on this, but it’s usually the easier part. The harder part will be agreeing on and instrumenting the process for reaching out to that lead.

You need to agree on rules of engagement for free user PQLs - who reaches out to them, when, and with what messaging? How do PQLs factor into to your other lead generation and distribution efforts, like inbound marketing-contributed leads, and outbound sales-driven leads? Most organizations of a certain scale have some combination of all of these lead types.

There are a number of ways to decide how to assign PQLs. For free users, you may send product qualified users to a BDR team for further discovery. You may send PQLs that are paying users to an account management team for expansion. You may send trials to your new business team. You may form a cross-functional growth team that focuses exclusively on growing free and low-cost accounts.

If someone has been using your product for a few weeks in a free trial, they're going to have different assumptions and information than a prospect who came in from a whitepaper download. Are your sales reps prepared to handle the differences between those prospect types? Or do you have some reps work trial PQLs and other reps work MQLs and others do outbound prospecting?

No matter what, you need crystal clear rules of engagement and compensation structures. There's a lot that goes into making this work.

You’ll need to answer a few questions, like:

- Who: Which reps own which accounts? Which customer segments go to which reps?

- What: What criteria go into a PQL so it qualifies for assignment?

- When: When do accounts move into or out of a rep’s ownership? What kind of SLAs do you enforce to ensure reps are following up quickly?

- How: How will you assign accounts? How will you manage conflict?

PQLs require different handling, including different SLAs, than other kinds of leads. You want to take action with a PQL as soon as the timing signals are right (like the user performing a product action), so you need agile account distribution that can happen quickly and regularly.

Because of the unpredictable nature of PQLs, it will be hard to assign PQLs to reps using a traditional geographic or other static territory model. A straight round robin seems simple, but you’re going to end up with imbalanced books pretty quickly.

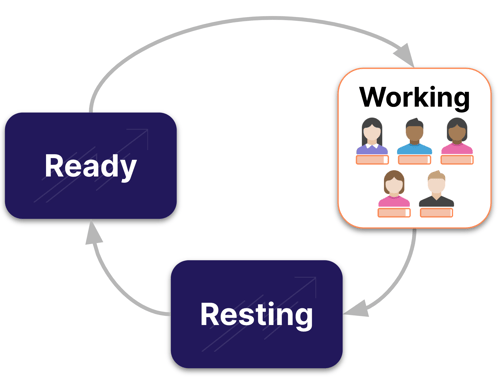

The best territory structure for a PLG sales organization is a dynamic books model. In dynamic books, every rep is assigned a book of accounts, based on account fit and PQL timing signals, as well as the rep’s available capacity. When an account is converted or disqualified, it moves out of the rep’s book and a fresh new account moves in.

Will you have different target books for different lead types? For example, you may have a mid-market segment, and 10 SDRs assigned to work mid-market leads. Mid-market leads may convert more quickly or easily than enterprise leads, so mid-market SDRs can handle larger account books. Maybe a mid-market SDR can handle 100 new leads a month, but an enterprise rep can really only work 25.

How will this impact rep compensation? Are product leads comped differently than other leads?

What does it take to disqualify a PQL? Figure out what criteria you need to establish that an account has been fully worked, and when it moves out of a rep’s book when those criteria are met. How long does a rep own a particular PQL? When does it move out of a rep’s name and back into a general account pool?

How often do you assign new accounts to reps? Is this a continuous process triggered by real-time (or close) timing signals? Do you distribute new accounts once a week or once a month? If you have free trials, are they assigned to reps immediately upon signup?

Once you've figured out your rules of engagement and you know to whom product qualified leads will be routed, you need to figure out how to actually route them. PQLs are often associated with existing accounts in your database, so lead-to-account matching is extremely important for determining account ownership. You have to know what account the user you've identified as a PQL is associated with, so you can assign that PQL to the appropriate sales rep to upsell. You can read more about lead-to-account matching here.

You can use PQLs alongside the MQLs and SQLs you already rely on if you take a thoughtful approach to how and where you identify new product qualified leads, as well as how you'll ensure clear ROE for PQL account ownership. Hopefully this framework helps you get there.

When does a user become a PQL?

So now let’s talk more about how to identify PQLs. What qualifying signals do you look for? When do you send a potential lead to a sales rep? The signals you should be looking for relate to fit and timing. Ideally, you want to find potential upgrades in your userbase - users who are a fit with your paying customers and are ready to buy. Those users become product qualified leads (PQLs) for sales reps to contact.

Let’s talk briefly about fit and timing signals, and then go into more detail about how you can use these along with some common PLG structures, like free trials, free product tiers, and more.

Fit signals

You need to know if a particular user is a fit for the paid version of your product. For those of us in B2B, that means the user is employed at a company that fits our ICP. That may be based on firmographics like company size, industry, revenue, employee count, etc... If you’re in B2C, you may look at individual demographics, like a user’s age, gender, location, and more.

It’s worth considering if you want your reps reaching out to free users who don’t look like a fit. Some companies use automated nurture cadences to keep those users engaged. Others assign users to a sales rep for personalized outreach to see if anyone responds. And some companies just ignore users that aren’t a fit. It’s tempting to try to find a diamond in the rough of your non-fit users, but it’s typically a waste of time to reach out to them individually. You should instead focus on the users that fit your ICP.

Timing signals

Timing is all about signals. Timing signals are actions a user takes that indicates some further level of engagement with your company, your product, or the problem your product solves. Some PLG timing signals could include:

- Product usage

- Website engagement

- Email engagement

- Social activity

- Customer support interactions

- Hand raise

- Free trial timeline or limits

You need to figure out what combination of signals work for you. What actions indicate that you should consider a free user a lead and send them to sales?

Some signals should result in an instant distribution - for example, if a free user raises their hand to request a demo of the full product, you should connect with them with a sales rep right away. You just need to set up automated lead routing for this use case and be sure a user is quickly matched to an existing account if one exists, and assigned to an available sales rep based on your routing rules.

But other signals are additive and accrue over time, and this is where it gets more complex. For example, consider a free user who regularly opens your marketing newsletter, reads blog posts on your website, and/or uses different aspects of the product. On their own, these are minor signals that they might be interested in more. But together, they indicate significant interest.

Some companies assign a score to each action and then when a user surpasses a score threshold, they’re distributed to sales. To (over)simplify this process, imagine that you assign 1 point per action a user takes, and when a user reaches 10 points, they’re considered a PQL and sent to sales.

You need to identify the timing signals that make sense for your product and your customer.

3 types of PQLs

For product led growth companies, there are 3 basic types of PQLs. Each one comes with its own benefits and challenges.

|

Access Model |

Description |

PQL Considerations |

|

Free Tier |

The classic "freemium" model with a no-cost, minimal tier of your product. |

Identify engagement that signals interest in higher tiers. Encourage hand-raisers. |

|

Free Trial |

Prospects temporarily evaluate a fully-featured version of the product at no cost. |

Nurture adoption from day one to drive a decision by the end of the trial. |

|

Usage-Based |

Users start using the product at no or low cost and then pay more as usage increases. |

Identify accelerating usage or milestones where you can drive commitments. |

Let's talk about each PQL type in more detail.

Free tier

If you have a free version of your product, there are likely a number of good leads hiding in your free user base. The issue is identifying them - it's trickier than it might seem at first.

Signals you might look for include high levels of activity, usage of particular features, regular logins. You can also look at the user themselves. Is the user a good fit for one of your buyer personas? What's their job role and seniority level? If they're not the decision maker, can you get to a decision maker through them? Further, does the company they work for fit your ICP? Look into firmographics like company size and growth rates, as well as any other specific traits that fit your ICP model.

Another signal could be if the user is bumping up against the limits of a free version. Lots of products have functionality that’s only available to paying customers, and when a user encounters that functionality in a limited trial version, they may see an upsell CTA. If a user encounters enough of those CTAs - even if they never click the demo button - you should consider reaching out to them. It certainly seems like they have a need.

Free trial

When executed thoughtfully, a free trial program can be a great way to source PQLs.

A free trial signup starts a clock ticking on the time you have to close that deal. Your trial is likely time limited and a user only has access for a few weeks. What’s the ideal time to reach out to a trial user? If you reach out too early, they won’t have had a chance to try things out fully yet. But if you wait too long, you may have missed your opportunity.

Some companies opt to automate a trial nurture sequence that sends messages throughout the trial period, giving the user a chance to learn more when they want to. This can work, especially if it’s personalized to the user’s needs and the actions they’re taking in the trial.

But depending on your scale, we recommend having a real person (or people) managing trials. Have a tight plan your reps follow to nurture prospects through the trial period. They can do outreach based on trial signals (time left, product actions done or not done, etc..). This is particularly effective if your process is a combination of automated and manual - for example, a trial user is nurtured automatically, but they become a lead that's routed to a sales rep for manual outreach if they do something specific.

You may need to play offense - encouraging an active trial to go deeper or showing them how they can apply what they're doing to something else. Or you may need to play defense - convincing an inactive trial to actually use the product. Different trials will require different sales processes.

Depending on the scale of your free trial program, consider having a sales rep closely monitor every trial's progress with regular check-ins. Unattended trials just don't convert at the same rates as attended trials.

If you're running a high-velocity free trial program, automate check-ins throughout the trial period. Remind users about what they can do in the trial, how they can use your product in their jobs, how much time is left. Ideally, you're doing this in the product itself, as well as through email and other communications.

Make sure there are governors on free trial usage. If you have any one-off but high-value functionality, consider limiting that in the free trial. For example, data exports or detailed reports should only be available to paying users. Otherwise, someone could sign up for a trial, download a comprehensive spreadsheet and then cancel.

Usage-based

Another way to identify PQLs is to look at users who use your product in a certain way. This can fall into two categories: an account that's reached some kind of limit, such as on user logins or data used, or an account that's achieved certain product milestones, signs they're successfully using your product.

If an account is adding users, that's a good signal. Also, look at who those new users are. Are they individual contributors, leadership, ops? Different roles will mean different things, but generally the more users are active in your product, the harder it will be to stop using your product.

If user engagement isn't your key usage metric, then you obviously need to focus on that metric as well. Are there certain features that drive usage with historically successful customers? Or maturity milestones an account can reach? Product marketing can play a role in determining the criteria for a PQL - they sit at the intersection of product and your GTM teams, so they have a deeper understanding of both your sales process as well as your product. Once you've identified those criteria, make sure you can instrument them in your CRM (hand wave, hand wave).

A big concern with a usage-based PQL is account assignment. If someone is already a paying customer, who owns that account? Is that the same person who will own the upgrade or expansion? More on assignment in a minute.

A note about hand-raisers

If someone proactively reaches out to learn about an upgrade, this can be a strong buying signal, but it isn't always. Regardless, if someone raises their hand to say they're interested in an upgrade or demo, get back to them quickly. These leads likely don't require additional BDR qualification before going to an AE or AM, since they've volunteered to learn more.

Always include a way to upgrade or contact sales in the product itself. Make it easy for a user to learn more. And include information about the path they used to raise their hand in your CRM. For example, if they were in a particular part of the product when they requested a demo, that tells you something about what they're interested in.

Good luck!